株 FX 仮想通貨すべてに共通しますが、買いから売りの反転ポイント、売りから買いの反転ポイントが分かる人はほぼ100%プロトレーダーとして生きていくことができます。反転ポイントからの売りや買いの初動はとても勢いがあり、大きな値幅を取れるため、一番おいしいポイントでもあります。今日のこの記事はFXを例に出していますが、株や仮想通貨のトレードでも応用が利くため、トレード幅広く役に立つはずです。買いから売りの反転ポイントに特化して記事にしています。

日足、週足で方向性を確認

まずはチャートの日足、週足を見てみましょう。全体の方向性が売りの方面であることを確認してください。あまりにも売られ過ぎている場合はトレンド転換の可能性がありますが、それ以外の場合であれば日足や週足が売りであれば間違いなく売り方向へ全体の流れが動いていくはずです。

直近の下落から40~70%戻るまで待つ

下記チャートは2022年1月の豪ドル円1時間足です。青枠で囲った部分が大幅な下落をしたポイントですが、83.7円から82.1円まで160pips落ちました。40%~70%程度買い戻しが来るまで待ってください。買い戻しが来る前に落ちた場合はその落ちた分も含めて40%~70%程度買い戻しが来るまで待ってください。 落ちた後にエントリーしてしまうとそのあとに来る買い戻しでかなりきつい含み損をかかえてしまいます。そのため買い戻しが来るまで必ず待ってください。

反転ポイントを見つける

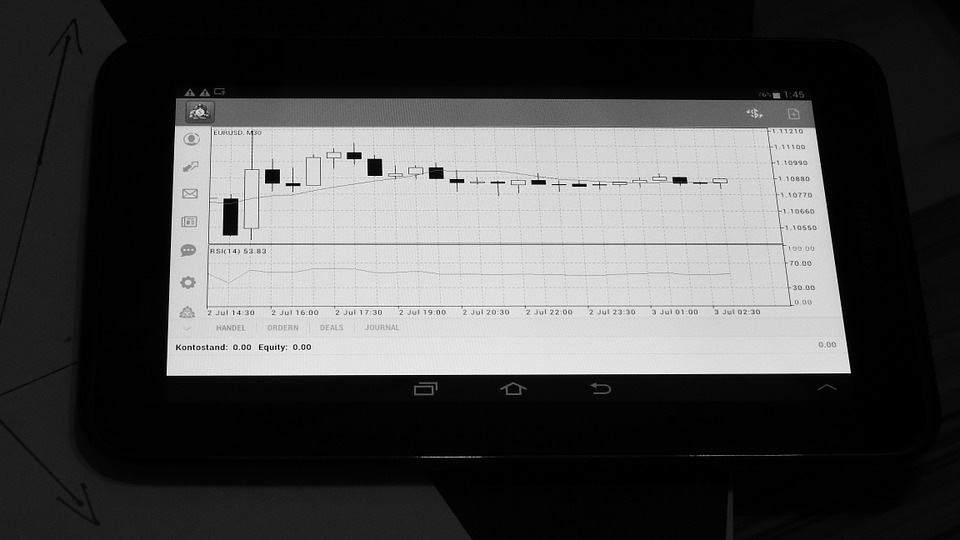

買い戻しが来るとあるポイントで同じ価格帯で上髭をつけてもめ始めます。30分足にしてこのポイントが来るまで待ってください。このもめているポイントは仮に勝っても負けても重要なポイントと言えます。買いと売りが50対50のパワーバランスで激しい攻防をしているポイントだからです。赤枠のようなポイントが出来たらエントリーチャンスです。エントリー後は見守り、順調に落とせば成功、直近の高値を更新してしまったら一旦諦めてポジションを落としましょう。USD/JPYやAUD/JPY、EUR/USDのように緩やかに動く通貨ペアは1時間足でもこの傾向を確認できます。GBP/JPY、GBP/USDなどは動きが激しく、さらにトレンドが出るのも早いため30分足をお勧めします。

ずっともめている場合

ずっと売りと買いが数時間以上揉めている場合は一旦買いが勝ってしまうことが多いです。下記の図の青枠のように何時間ももめていますが、一旦上に20pipsほど上がっています。そのあと同じ価格帯で上髭が出た後に下落しました。その後130pips落としています。

逆へ行ってしまった場合

確率的には低いですが、逆へ行ってしまう場合もあり得ます。V字のように戻ってしまうパターンで、高確率で全戻しどころか上へトレンド転換する可能性すらあり得ます。下記の図のようなパターンにもなりえるため、落とした分の80%以上買い戻しがきたら、2つの選択肢を考えます。

- 目線を切り替えて上についていく(買いでエントリー)。

- 売りでエントリーを諦めて一旦様子を見る。

トレンド転換と併せて使うと効果的

以前紹介した記事で上昇から下降トレンドへの転換という記事を書きましたが、この手法と併せてやってみると上手くいきやすいです。勿論やるときは常に損切りポイントを必ず指定しましょう。直近の高値を更新したら逃げるようにしてください。

コメント